Bridging the Female Funding Gap | European Scaleup Monitor 2021

Jaqueline van den Ende, CEO and co-founder of Carbon Equity, is a serial entrepreneur and role model featured in the SHE LEADS Dashboard 2022. She combines her expertise in funding with her passion for climate change when leading Carbon Equity, a climate investing platform for alternative investments. Find out in this expert insight article from our latest edition of the European ScaleUp Monitor how Jacqueline believes we can bridge the female funding gap.

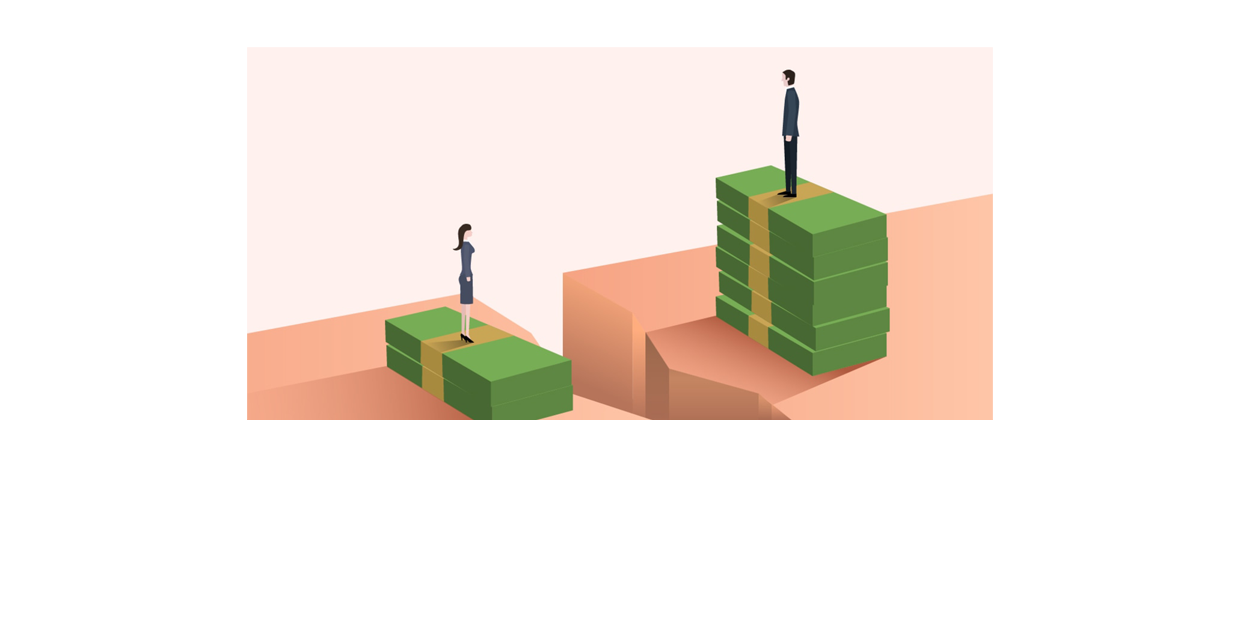

According to research by Dealroom, female-led startups raised less than 3% of the total $120bn in funding. Furthermore, when they raise capital they typically raise smaller rounds. Why are women anno 2021 still lagging in the fundraising game? I believe there are 3 key assets that help founders get funded: Network. Knowledge/ understanding of the fundraising process. And most importantly: Confidence.

The confidence gap

Most new entrepreneurs lack an understanding of the fundraising landscape. But what female entrepreneurs seems to lack more than male entrepreneurs is network and confidence. Confidence is the hardest part to fix because it is the most deep-rooted/structural challenge. Network and knowledge we can ultimately fix. But confidence is a different ball game. My hypothesis is this:

White men grow up in a world in which every successful person ever looks like them. There are white male presidents, tech billionaires, or open a random website of a top tier law firm or investment firm… and it’s likely by and large male and white. As a result white men grow up believing that they can achieve anything. Yes they can be an entrepreneur. They see examples left and right. So why could they not do the same? Starting a company is a risky endeavor. So the main ingredient you need to start a company is self-confidence, the belief that Yes you can!

Confidence also very much reflects in the ability to think big or bigger. Women start many companies, but I often see that women struggle to think as big as their male counterparts or fail to communicate their ambitions in the same exponential proportions. This is part realism and/or more humble communication – which I think is a great virtue (that requires different listening/interpretation skills on behalf of investors) and part perhaps lack of confidence that they can build a global business. Why? Because you have seen no one like you who did the same.

The network issue

Then there is the network issue. Male entrepreneurs typically know other male entrepreneurs who know investors. Hence they can learn about the process from their friends and perhaps through referrals to get in touch. For women – who have no network – getting in touch with investors is perhaps a bridge too far. Women also tend to be more apprehensive to contact investors. ‘Is my business even fundable, am I worthy of an investment? Perhaps – but then let me raise a small amount rather than a big funding round based on my big bold vision’. Early-stage investors need to believe in one key thing and that is you as an entrepreneur. I dare say early-stage investors invest in something like 90% founder confidence and capabilities and 10% idea. So you better come with a big bold, exciting vision, which you wholeheartedly believe to get people on board in that early phase.

So how do we solve this?

First I think we need some big structural changes that fortunately are already well on their way. We need children books with female CEOs and surgeons. We need to teach kids entrepreneurship in school so everyone learns that “Yes, they can!”. We need to highlight the role models that we have. We need to build self-confidence, practise our pitches, learn the lingo, learn to stand tall and bring it. Initiatives like the We Rise program do exactly this and are immensely helpful in building up those skills and that confidence. We need network – make it easier to get in touch with investors. There are some great initiatives with female investors uniting and hosting office hours for female founders so it becomes a lot easier to sign up and get in touch.

Finally, we also need to get rid of our biases, which I dare say, are equally large for female investors as for male investors. Unfortunately, the mental picture that comes to mind when speaking of successful entrepreneurs is white and male. This is by and large simply the truth. So we need to rewire. This requires time – but in the short run – awareness of and attentiveness to our biases can go a long way in mitigating them. Honestly, as women we can do a whole lot more to support each other, build up one another’s confidence, rather than competing.

Women, let’s bring it! The future is female and diverse!